In Oman’s diverse real estate market, investors and property owners often face a key question: do they need a Mortgage valuation or a market valuation? While both serve important purposes, each one is designed for a different goal that can directly impact your financial and investment decisions. Understanding the difference helps you choose the right type, reduce unnecessary costs, and make well-informed decisions based on clear professional standards. In this article, we outline what each valuation means, when to use it, and why.

What’s the Difference Between a Mortgage and a Market Valuation?

Mortgage Valuation

Mortgage valuation is conducted when applying for a mortgage or property-backed financing. Its main purpose is to determine a value the bank considers safe as collateral for the loan.

This type of valuation focuses on risk reduction—how the property’s value might change over time and how easily the bank could sell it in case of borrower default.

In Oman, Mortgage valuations must be carried out by licensed property valuers approved by the Ministry of Housing and Urban Planning and in accordance with official valuation standards.

Market Valuation

A market valuation reflects the real-world value of a property in the open market—the price a property could reasonably sell for based on supply and demand.

It is commonly used by investors and property owners when selling, buying, making investment decisions, or requesting an independent valuation report.

In Oman, market valuations are regulated under the Royal Decree No. 79/2025, which governs real estate valuation and valuers.

In Muscat, market valuation typically considers three main components:

Construction cost

Comparable property prices

Recently recorded actual transactions

Key Difference

- Mortgage Valuation = Determines collateral value and assesses lending risks.

- Market Valuation = Determines the true market value for buying, selling, or investment decisions.

Why are these differences important in Oman?

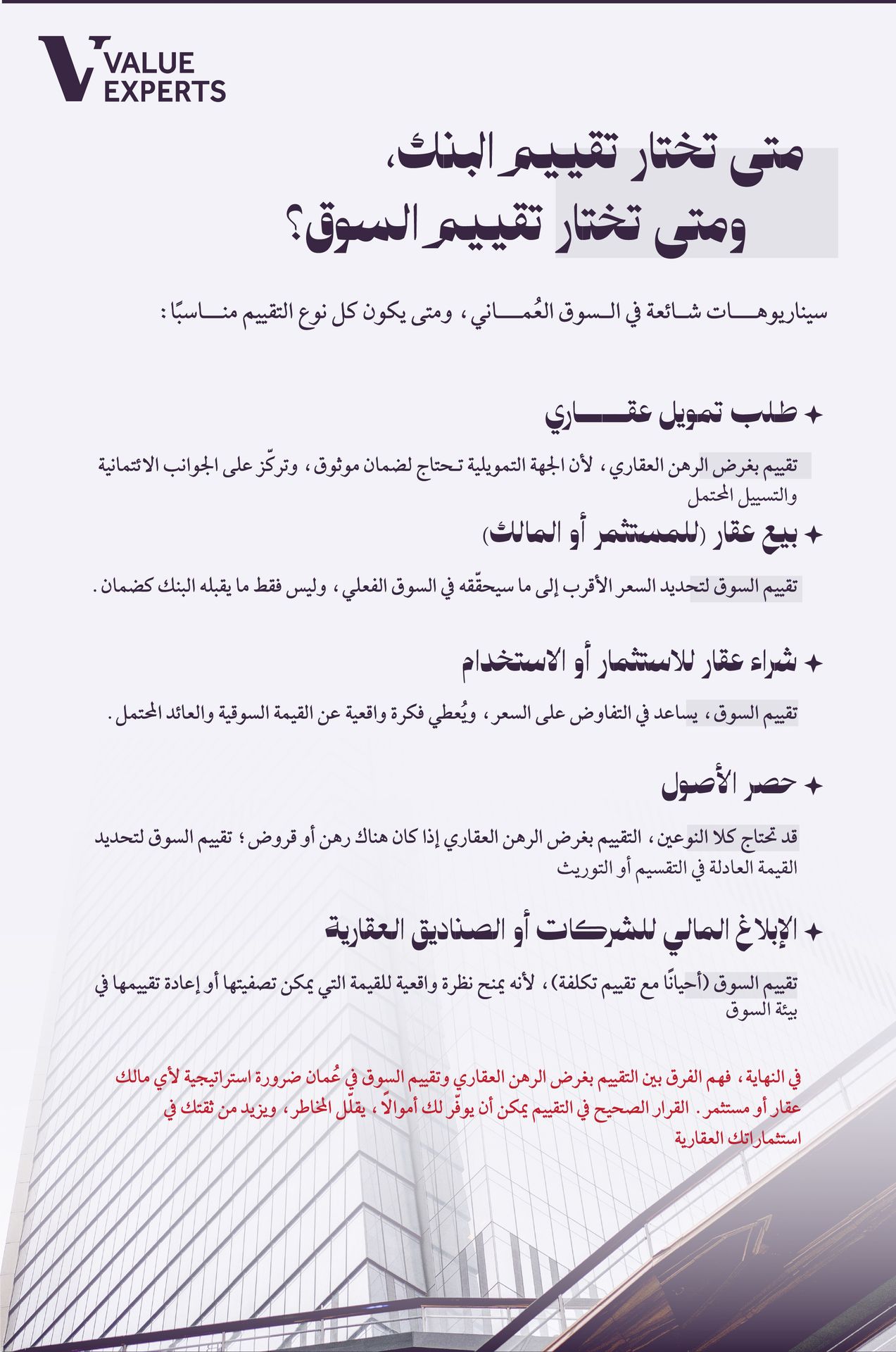

Understanding the distinction between bank valuation and market valuation matters in Oman for several key reasons:

Regulatory Risks:

With Royal Decree 79/2025, the real estate valuation sector became more structured, reducing the risks that previously existed due to the lack of unified standards.Fees and Charges:

Ministerial Decision 570/2025 introduced updated valuation fees, showing that valuation is not just about identifying a property’s worth but also a regulatory tool used in calculating real estate fees.Investor & Lender Confidence:

Market valuation enhances transparency for investors by showing the real achievable market value, while bank valuation reduces credit risks for lenders—although it is typically more conservative.Size of Oman’s Real Estate Market:

The residential market is valued at USD 4.38 billion (2024) and is expected to grow, with the commercial sector also expanding—making valuation a strategic tool for buyers, sellers, investors, and institutions.

In the big picture of Oman’s real estate market, understanding the difference between Mortgage valuation and market valuation is no longer optional — it’s a smart necessity for every owner and investor who wants to make decisions with confidence. Knowing the distinction helps you make more accurate financial decisions, save money, reduce risks, and stand on solid ground before any sale, purchase, or financing step.

And if you’re considering getting a property valuation today — for any purpose —the Value Experts team is ready to be your professional guide: officially licensed valuers, strong field expertise, and accredited standards that provide you with a valuation you can trust.